For the past 10 years, retailers have transitioned from being pure sellers of goods to technology companies that sell products. Now, they’re adding another feather to their hat: solution provider.

The most prominent example of this shift is the rise of Retail Media Networks. According to research from the Walton Business School, there are over 600 Retail Media Networks, with Insider Intelligence forecasting spend on these digital advertising platforms to reach $60 billion in the U.S. alone in 2024.

Sitting at the intersection of advertising and commerce, Retail Media Networks provide the chance to see a consumer’s path to purchase and influence shoppers throughout the funnel. They use first-party data with closed-loop reporting, and promise to unlock personalised communication at scale. They also allow retailers to capitalise on the blurring lines between digital and physical shopping, driving the incremental opportunity of seamless experiences where every touchpoint is shoppable.

Perhaps most importantly in an inflationary environment that’s squeezing consumer spending and pressuring the industry’s profitability, Retail Media Networks promise adjacent revenue streams to boost companies’ income and margin.

Yet despite their myriad opportunities, these nascent offerings present retailers with a number of challenges, including how to provide unique value to brands in a crowded market; how to deliver highly sought after data within today’s infrastructure constraints; and which capabilities to develop to lead in the future.

The Retail Opportunity

Anyone who has sold products through Amazon is familiar with the range of services offered by Amazon Ads. What’s made this service so valuable for Amazon and its vendors is the ability to more directly attribute ad spend.

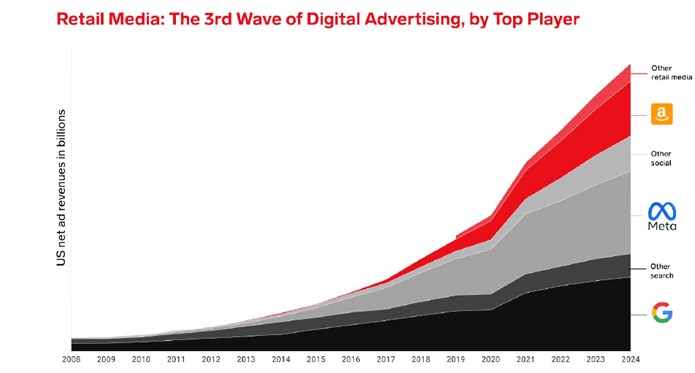

“This value proposition, with such clear return on advertising spend [ROAS], has led retail media to become one of the fastest growing segments of digital marketing spend,” said Andrew Lipsman, principal analyst at Insider Intelligence. “Retail media ad spend follows search and social as the three big waves of digital advertising – and I’m increasingly convinced it’s destined to be the biggest of the three.”

Amazon captures around 75% of all spend on Retail Media Networks in the U.S. However, their potential to boost retailers’ ecommerce profitability has caused hundreds of others to launch their own offerings.

Some are now firmly established, like Walmart Connect–the origin for which can be traced to Walmart bringing its digital marketing functions in-house back in 2019. Yet others are more nascent. At Groceryshop this past September, Ahold Delhaize announced its intention to build a €1 billion Retail Media Network; the following day, Morrisons in the UK announced it too is creating a new Network.

This abundance of offerings will create a long-term challenge for retailers looking to grow their business and brands deciding with which retailers to partner. In a low-growth, margin-pressured environment, retailers that can prove incremental sales to brands will be best positioned to succeed, though all networks may benefit from tailwinds as social and other forms of digital marketing are perceived to be less cost effective.

Building Value for Brands

For brands, unlocking the value of Retail Media Networks along the full path to purchase will be covered in detail during a dedicated session at Shoptalk Europe in 2023. The European session will feature insights from Simon Miles, vice president of global omnichannel commercial strategy at The Coca-Cola Company.

Miles said he views the first steps for brands as being aligned internally across departments and ensuring activity is linked to the organisation’s strategic goals.

“We believe that brand, rather than trade marketing teams, should own the retail media relationship,” he said. “We’re mindful, though, that there’s a real chance our commercial team can be unsighted, which is increasingly problematic if the engagements form part of the joint business plan.”

The dynamics between brand and retail organisations are changing as a result of this new business model, too. While the retailer has long been the brand’s customer, within the context of Retail Media Networks, the brand is now the customer. Miles said he’s optimistic that this dynamic can redefine brands’ relationships with retailers and lead to mutual collaboration.

There is, however, a gap between the potential of Retail Media Networks and the current reality, Miles said. He attributed this gap to inconsistencies around technology platforms, the quality of data provided, and levels of trust across networks. The Coca-Cola Company is developing a consistent segmentation of networks to determine investment levels based on their ability to deliver, as well as developing its own capability to use the data provided and create consistency of measurement.

Ricardo Belmar, director, and partner marketing advisor for retail and consumer goods at Microsoft, said he expects more networks to be able to deliver the desired data by next year.

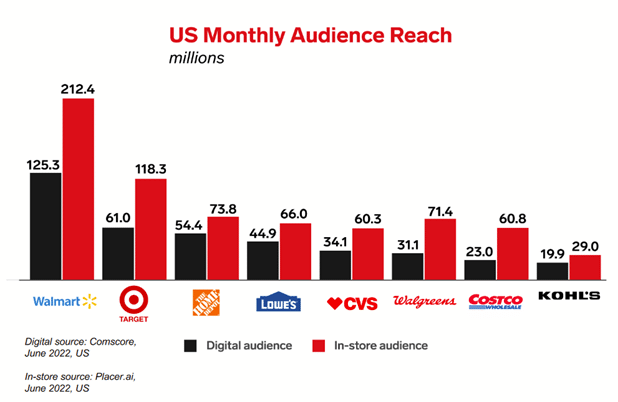

“For the retailers, it’s all about ensuring their underlying technology platform can provide the required data, and working with their technology partners to ensure this,” he said. “For FCMGs, though, it’s all about audience reach and audience targeting, and here the level of duplicity is a problem. Retailers only have the data on their own shoppers, yet people shop around. How, as an industry, this gets aggregated is an as yet unsolved challenge.”

For both retailers and brands, grasping incremental opportunities may require analysis beyond an organisation’s current capabilities, requiring upfront investment in data scientists and infrastructure. Talent is in high demand, though, and the later this is left, the more expensive building these teams will be.

Where We’re Headed

Shoptalk Europe firmly believes that Retail Media Networks will be an important part of future digital marketing and retail ecosystems. The opportunities to deliver genuine value to both retailers and brands are clear, though work is still required by all parties to unlock this value.

They expect to see more networks launch, as additional retailers seek the adjacent revenue and margin opportunities. This fragmentation with overlapping audiences, very few of whom are loyal to just one retailer in each category, could create the environment for disruption.

While brands will invest in trade spend with all priority retailers, consolidation or even third-party aggregation could impact the individual walled gardens. This trend is already being brought to life through offerings by the likes of Instacart and Doordash. A highly fragmented market could also open the door to industry standards being created, for example in measurement or nomenclature.

One particular element of Retail Media Networks that is exciting is their potential to be creative, collaborative spaces that foster innovation. Two opportunities that already exist for early adopters are livestreaming with Walmart Connect and Firework, and connected TV with Amazon Ads.

Finally, as Retail Media Networks mature, they will evolve from online-only offerings to omnichannel propositions. Analysis from Insider Intelligence highlights the opportunity for in-store assets including screens and end caps to surpass the audience reach of retailers’ digital properties.

Shoptalk Europe takes place from 9-11 May in Barcelona. Members and companies associated with ecommercenews.es can get a 10% discount off current pricing here: https://hubs.ly/Q01yTQnC0